Eight simple steps you can take to make your UK tax return stress free

Over 750,000 people submit their tax return late, incurring sizable fines and late filing penalties. Follow these eight simple steps to help you stop worrying about your tax return

Written by E4E Editor on 14 October 2022

It’s never too late or early to ensure that your documents, records and financial matters are in good order before next years’ deadline.

Proper preparation would mean that you spend less time worrying about the tax man and have more time to relax, whatever the time of year.

Did you know that in 2021 over 750,000 people missed the tax return deadline, each immediately incurring a £100 fee?

Proper preparation, especially when living abroad, can ensure that completing a UK tax return is stress free, but it can also mean that you are fully aware of any rebates or underpayments which you may have to account for in the future.

If you are in any doubt about any aspects in this article, you should speak to a UK tax specialist using our free introduction service and they will be able to help you with any UK tax return and tax residence status questions.

Proper preparation will reduce your costs

Keeping your financial matters in order can also mean that, if you use an accountant to file your tax return, you can reduce their charges by minimising the amount of time they have to spend organising your documents and records.

One of the biggest concerns accountants in our networks have is that clients are unnecessarily spending money on accountant fees for simply sifting through and trying to understand the various documents and receipts - something which could be avoided by being better prepared and organised to a basic standard.

After all, what would you rather your account was working on, trying to sort through your documents or identifying opportunities to reduce your tax bill?

We’ve brought together a number of things you can do in each financial year to keep your financial affairs in order and submit a stress free tax return each year.

Store all documentation securely

Whether you live in the UK or abroad, if you have to file a tax return it is vital that you store your documentation securely.

If you are planning to move abroad in the next twelve months, taking your tax return into account is an important factor to consider and ensuring your paperwork is accessible and stored securely is vital to ensuring that you do not fall foul of any penalties.

The HMRC could fine you up to £3,000 if you have not kept the proper documentation and records for the previous six years – although if the HMRC suspects fraud, they may wish to investigate back as far as 20 years.

When choosing a suitable location to store your documents you should consider not only accidental and malicious damage (such as fire or flooding), but also ensure that only the people who need to have access can access your documents.

What documents and records do you need for your tax return?

When completing a tax return the following UK documents are most commonly needed by you or your accountant:

- Your P60 and/or P45 from your employment

- Details of income which you received from self-employment

- Details of any pension contributions

- Details of pension receipts

- Details on income received from property or land (such as rental income)

- Records of any capital gains or losses accrued in the financial year

- Income received from your savings or your investments

- Details of any additional income you have received

- Details of gifts and donations made to charity

If you are classed as a non-resident for tax purposes, but you still need to complete a tax return, only income, gains or losses resulting in UK based activity will typically need to be considered for your tax return.

To determine whether you are a tax resident either you or a tax specialist will need to complete the Statutory Residence Test which will include a review of how many days you have spent in the UK in the tax year. Therefore it is recommended that you always maintain a record of the days/nights you have spent in the UK along with any work you have performed in the UK (by the hour) and be able to share this easily when requested whenever the need to assess your UK tax residence status arises.

However, you should always seek advice on any income or gains about what tax is due.

Ensure you and your accountant have access to your key documents

It’s no use storing your documents where neither you nor your accountant can access them, even if they are secure.

This is important for both your tax return itself, and also other situations including HMRC investigations, unexpected events such as a death or accident.

However, just because you need access to them does not necessarily mean that you need to physically access them. When submitting your tax return, being able to see digital versions of your documents will suffice when bringing your figures together.

Therefore scanning each document, or taking a photocopy can often suffice – although your accountant may still wish to see the original documents, so ensure that even if you do not physically have the original copy in your presence, wherever it is stored, it is easy to physically access and distribute.

There are a number of organisations which provide this level of service, including your accountant, however sometimes it may be best to opt for a professional document storage company.

Maintain a spreadsheet of relevant expenditure and income

It may seem a little extreme to some but keeping a record of your expenditure and income on a spreadsheet can not only help you when it comes to filing your tax return, but it can also help you budget.

If you provide this spreadsheet to your accountant, they may also be able to offer advice about other opportunities to reduce your tax, providing your keep the relevant documents and receipts.

Keep your receipts

Much like maintaining a spreadsheet, keeping your receipts ensures that you keep a record of all your expenditure. You should automatically keep any receipts related to house improvements, professional services and major purchases as a record of that purchase.

However, you should also consider keeping a record of your minor purchases too and, when combined with your spreadsheet, you may find opportunities which could help you reduce your tax bill further.

Our recommendation is to use a bulldog clip and attach them to any relevant credit card bills, or monthly statements. If the receipts are digital, either print them out or store them securely on your computer in a well organised folder structure with sensible naming conventions.

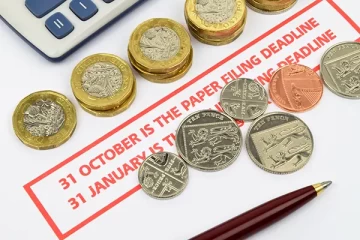

Don’t leave it until the last minute

The tax year runs from April, giving you 10 months if you are filing your tax return online.

Every January, every accountant in our network suddenly becomes inundated with files, requests and submissions – all of which need to be dealt with before the 31st January deadline.

While this in itself might not be a problem, the later you leave it the less time there is to ask questions or submit any missed documentation.

Even registration to file your tax return online takes 7 days to process – and not registering in time is not a sufficient excuse.

While there may be genuine reasons for a late submission, the HMRC are strict about their deadlines and the chances of avoiding a penalty are slim.

Follow these simple steps and you should be able to reduce your stress, complete your tax return early and also minimise unnecessary costs or tax bills.

Request a free introduction to a tax specialist to see how you can get your tax affairs in order

If you need assistance with your tax return, whether that's simply understanding if you need one or a full tax return preparation and submission service, you should start with a free introduction to one of our independent partners.

As part of the introduction you will be offered a short, initial free consultation will help you understand your responsibilities in the UK - and potentially in your country of residence. While the consultation will not include preparation and submission of your tax return, you will have your general questions answered and provide you with a fee quotation if you would like further assistance with your tax return.

Testimonials from people who have used our UK tax introduction service

I am very pleased with the speed and quality of information I received from Expert from Expats. It’s wonderful to have all information you need in one place, thank you for providing this service. You will never noticed how much research you need to do until you are in an expat situation and this website offers all you need.

Marcela B. United Kingdom, UK Tax Return

Response was quick and the advice given in 15 minutes was concise, understandable to a layman and useful. I also liked the fact there was no hard sell for follow up paid consultations. As much advice as possible was given in the time frame with a simple "get back to us" if you want to take it further in the future. Excellent service with no pressure to commit. As a result, when I do need to need their paid support, I'll have no hesitation.

Gary R. Singapore, UK Capital Gains Tax

The advice was clear and tailored for my personal situation. I was very impressed at the level of detail. Your advisor is clearly very knowledgable. Although I have no immediate need for assistance, I will certainly reach out when the time comes. Many thanks once again.

Matthew D. United States, UK Capital Gains Tax

Speak to a trusted UK tax specialist

Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs.

Once you have made your request, you will get:

- Free 15-minute initial discussion by email or phone to explore your situation and answer your basic questions.

- Informal guidance on the options available to you.

- Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed.

Speak to a trusted UK tax specialist

Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs.

Once you have made your request, you will get:

- Free 15-minute initial discussion by email or phone to explore your situation and answer your basic questions.

- Informal guidance on the options available to you.

- Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed.